India’s Goods and Services Tax (GST) system, introduced in 2017, was hailed as a game-changer for the country’s economy, streamlining taxes and boosting transparency. However, recent headlines have spotlighted a darker side: a massive ₹512 crore GST fraud involving fake invoicing. This crackdown by authorities has sent shockwaves through the financial system, raising questions about tax compliance, enforcement, and the broader implications for India’s economic growth. In this blog, we’ll dive into the details of this fraud, explore how it happened, and discuss what it means for businesses, taxpayers, and India’s economic future.

The ₹512 Crore GST Fraud: What Happened?

In June 2025, Indian authorities uncovered a sophisticated GST fraud scheme involving fake invoicing worth ₹512 crore. The scam revolved around the creation of fictitious invoices to claim input tax credits (ITCs) – a mechanism that allows businesses to offset taxes paid on inputs against their tax liabilities. Fraudsters exploited this system by generating fake invoices for non-existent transactions, allowing them to claim refunds or credits without actual goods or services being exchanged.

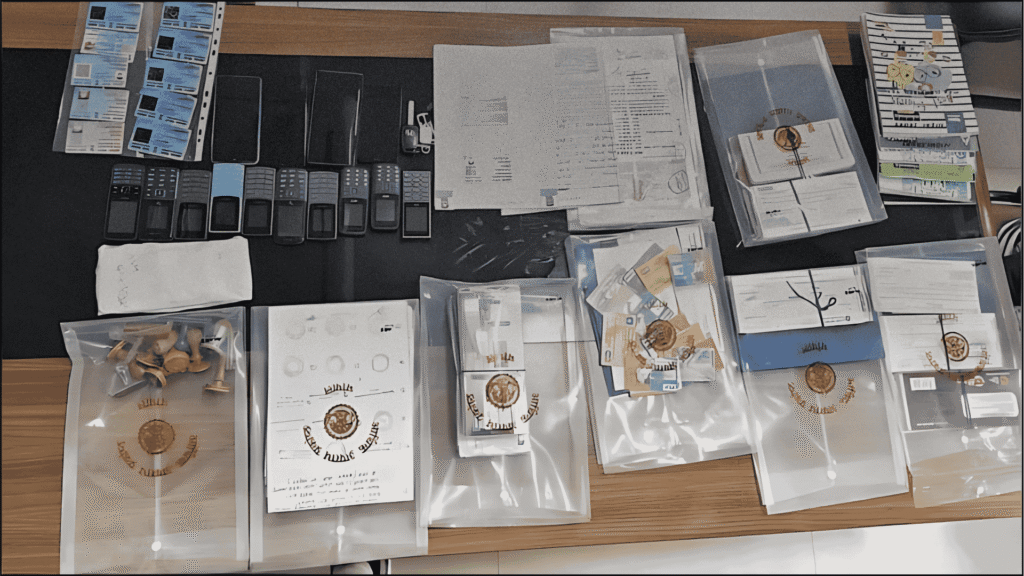

This wasn’t a small-scale operation. The fraud involved a network of shell companies and intermediaries who manipulated GST returns to siphon off funds. By exploiting gaps in the GST system’s verification processes, these entities created a web of fraudulent transactions, costing the government significant revenue. The crackdown, led by the Directorate General of GST Intelligence (DGGI), resulted in multiple arrests and ongoing investigations to trace the full extent of the scam.

For the average Indian, this news might feel distant, but it hits at the heart of the country’s tax system, which funds essential public services like infrastructure, healthcare, and education.

How Does GST Fraud Work?

To understand the scale of this fraud, let’s break down how GST fraud typically operates. The GST system relies on a chain of transactions where businesses collect taxes from customers and pass them on to the government, minus the taxes they’ve paid on their inputs. Fraudsters exploit this by:

- Creating Shell Companies: Fake businesses are set up with GST registrations, often using stolen identities or forged documents.

- Issuing Fake Invoices: These companies generate invoices for goods or services that never existed, creating a paper trail to claim ITCs.

- Claiming Refunds: By showing these fake transactions, fraudsters claim tax credits or refunds from the government.

- Disappearing: Once the money is secured, the shell companies vanish, leaving authorities to untangle the mess.

This particular ₹512 crore scam highlights the sophistication of such operations, which often involve multiple states and complex networks to evade detection. It’s a stark reminder that even a system as robust as GST isn’t immune to loopholes.

Why This Matters for India’s Economy

The ₹512 crore fraud isn’t just a number – it’s a dent in India’s fiscal health. GST is a critical revenue source, contributing over ₹1.7 lakh crore monthly in recent collections (June 2025 data). Frauds like this erode public funds, which could otherwise be invested in infrastructure, job creation, or social welfare programs. For a country aiming for a 6.5% GDP growth in FY 2025-26, as projected by Morgan Stanley and the RBI, such leakages are a setback.

Moreover, GST fraud undermines trust in the system. Small businesses, which form the backbone of India’s economy, rely on a fair and transparent tax regime to compete. When fraudsters exploit loopholes, honest businesses face higher scrutiny and compliance costs, creating an uneven playing field. For consumers, this can translate to higher prices if businesses pass on the burden of stricter regulations.

The Government’s Response: A Robust Crackdown

The DGGI’s swift action in uncovering this scam signals a strong commitment to tackling financial crime. Over the past few years, the government has ramped up efforts to strengthen GST compliance through technology-driven solutions:

- E-Invoicing and Real-Time Tracking: Mandatory e-invoicing for businesses above a certain turnover threshold ensures transactions are recorded in real time, reducing the scope for fake invoices.

- Data Analytics: Advanced analytics tools help authorities detect suspicious patterns, such as unusual ITC claims or mismatched invoices.

- Aadhaar-Linked Verification: Linking GST registrations to Aadhaar has curbed the creation of fake companies.

- Raids and Arrests: The DGGI has conducted nationwide raids, targeting networks involved in GST fraud, with the ₹512 crore case being a high-profile example.

These measures have already yielded results. In FY 2024-25, authorities detected frauds worth thousands of crores, recovering significant amounts for the exchequer. However, the scale of the latest scam shows that challenges persist.

The Road Ahead: Building a Fraud-Proof System

The ₹512 crore GST fraud crackdown is a step toward stronger economic governance, but it’s not the end of the journey. To prevent future scams, India needs:

- Enhanced Technology: Wider use of AI and blockchain to track transactions in real time.

- Simplified Compliance: Reducing the complexity of GST filings for small businesses to minimize errors and vulnerabilities.

- Public Awareness: Educating taxpayers about the importance of compliance and reporting suspicious activities.

- Harsher Penalties: Deterring fraudsters with stricter punishments and faster legal action.

As India aims to sustain its 6.5% GDP growth trajectory, a transparent and efficient tax system is non-negotiable. The government’s proactive stance is encouraging, but continuous vigilance is key.

Conclusion

The ₹512 crore GST fraud crackdown is a stark reminder of the challenges in maintaining a fair tax system. While India’s economy is on a strong growth path, fueled by domestic demand and institutional investments, frauds like this can erode progress. By leveraging technology, tightening enforcement, and fostering compliance, India can protect its fiscal health and ensure ascended to a global economic powerhouse.

For businesses and taxpayers, this is a chance to rally behind a transparent GST system. For policymakers, it’s a call to close loopholes and build a fraud-proof future. As India navigates these challenges, the crackdown serves as a testament to its resolve to safeguard economic growth.

Pingback: Gaza Ceasefire in Doubt: Trump’s Announcement Clashes with Ongoing Violence - cutizensbrain